THE “YACHT SELLING FORMULA

by Marcus Yachting

When it comes to selling your yacht, you must understand the “Yacht Selling Formula.”

Price

First and foremost, the price you set for your yacht is the one factor which determines the sale of your yacht above all else. The challenge with pricing a yacht properly is due to the fact that nearly every seller asks more than what their yacht is worth, while most buyers want to pay less than what sellers are asking. This fact makes pricing your yacht so challenging.

The “Hidden” Cost of Pricing High & “Testing the Market”

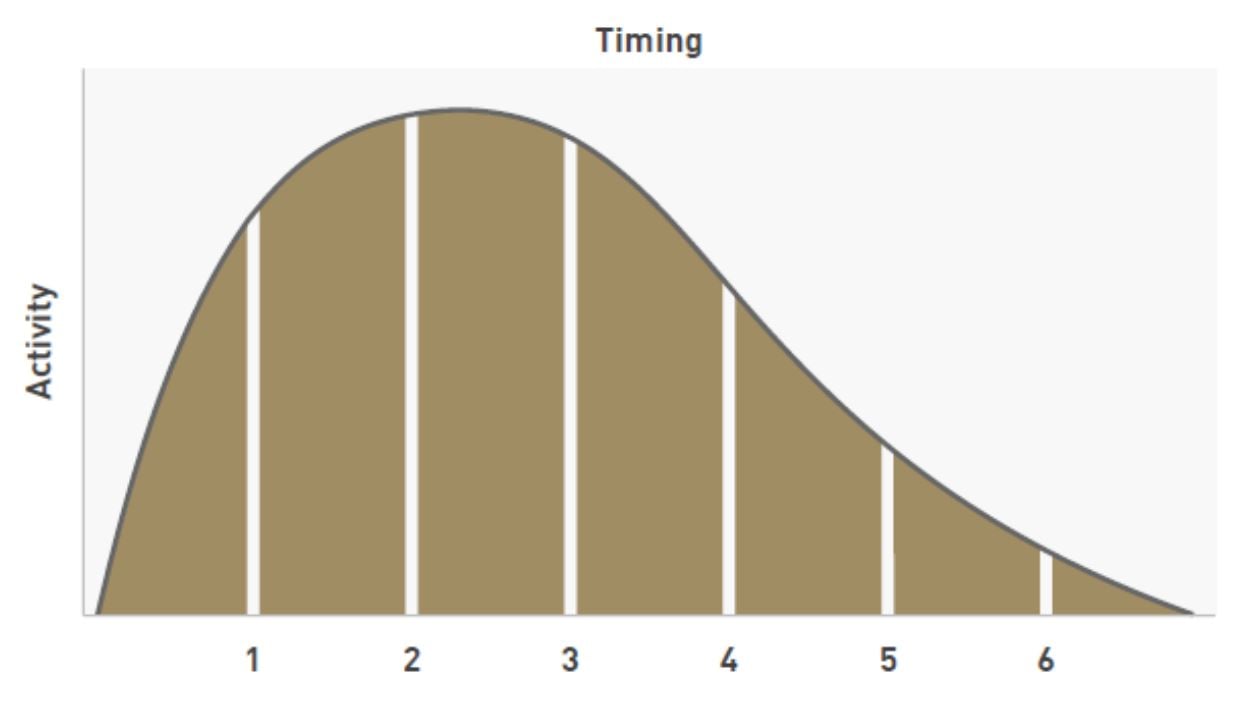

As you saw earlier, time is not your friend. In fact, it’s your worst enemy (due to running costs, depreciation costs, and market perception costs). When a yacht is first listed for sale, most buyers, brokers, and brokerage firms will see it suddenly appear on the market. Initially, interest and activity will build over months one and two. It will peak between the second and third month, then, after the third month, interest and inquiries begin decreasing substantially. At this point, in the eyes of the marketplace, your yacht becomes “old” and “stale.” And so, your initial “marketing momentum” is lost, and the excitement of your yacht diminishes.

Consequences of Improper Pricing

What this means is, if your yacht isn’t priced properly from “day 1,” your yacht will receive fewer inquiries, fewer showings, and fewer offers during the height of greatest activity. While you miss this “window of opportunity,” the three forms of costs begin to increase significantly, month after month. Eventually, you’ll end up having to sell well below your initial asking price while accruing depreciation, market perception, and running costs.

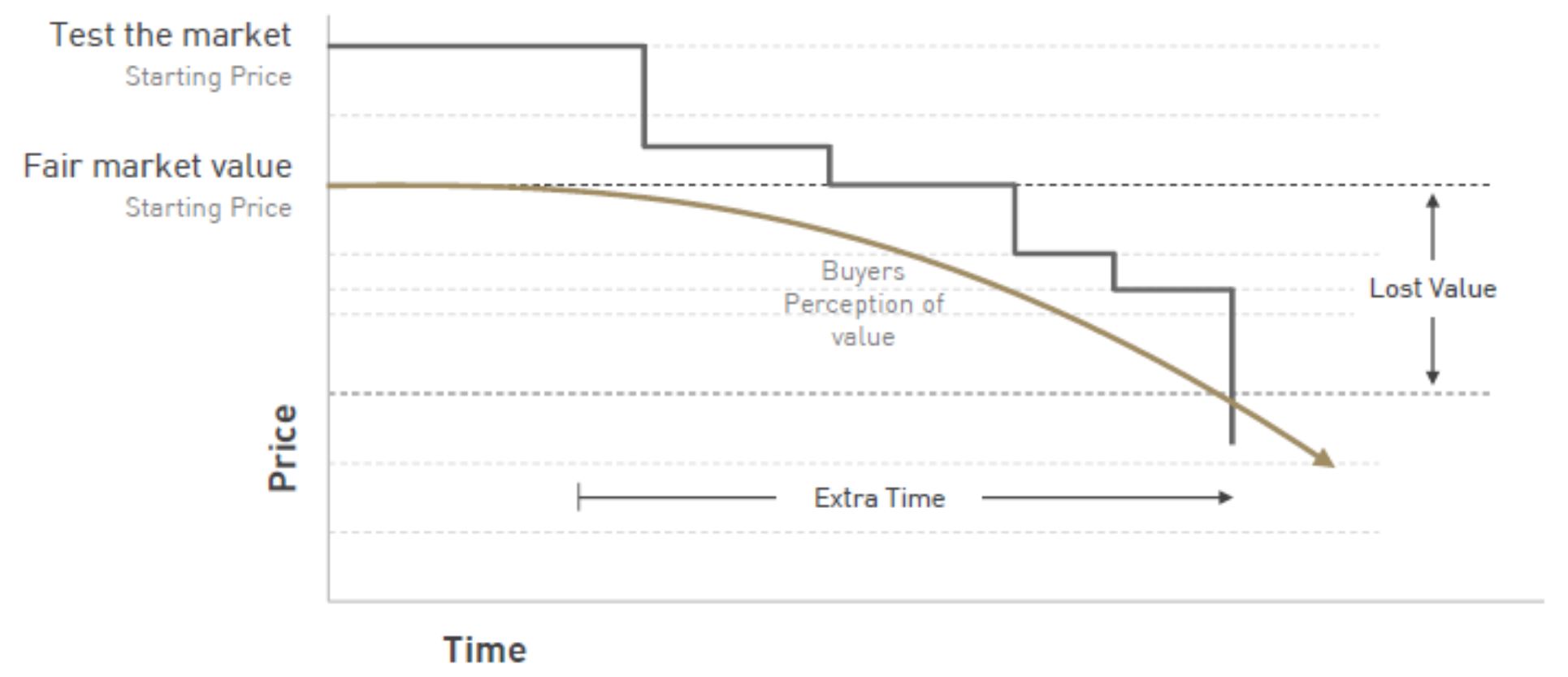

A common mistake sellers (or inexperienced brokers) make is pricing their yacht higher in the beginning to “test the market.” The rationale behind this is that you can always lower the price if you don’t receive any offers. Or, the belief that you need to build in a cushion for negotiation. However, as you’ve just seen, most of the activity occurs when the yacht is first listed. And once the initial pool of buyers has seen the yacht and it doesn’t sell, you’ll then have to wait for new buyers to come into the market. You will have no other choice but to reduce the price of your yacht to remain competitive.

Price vs. Time

Leaving your yacht on the market for too long might also create suspicion. Buyers and brokers may begin to believe that something is wrong with it and should be avoided. Also, if the market conditions are leaning towards a buyers market, it’s even more important that your yacht is priced correctly. In such a scenario, buyers are very sensitive to price and will look harder to find yachts that offer the most value.

The Challenge of Pricing Your Yacht

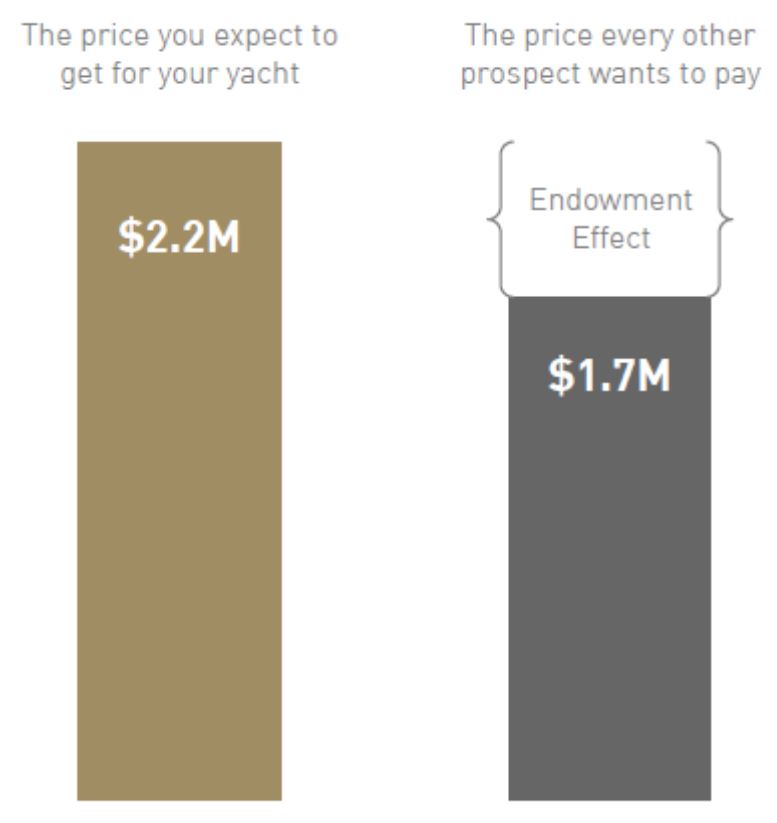

When we purchase something, whether it’s a pair of shoes, a car, or a yacht, a curious transformation occurs in our minds. Our sense of ownership creates a psychological shift.

Have you ever bought a new car and suddenly noticed the same model everywhere? This heightened awareness stems from an emotional attachment to your new possession. As a yacht owner, you may value your yacht more than the market does. If someone wants to buy it, you might want a price higher than they’re willing to pay.

This phenomenon is known as the Endowment Effect, or Ownership Effect. Behavioral economists describe it as the tendency to overvalue things simply because we own them.

Years ago, social scientists Richard Thaler, Daniel Kahneman, and Jack Knetsch conducted a revealing study. They gave coffee cups to half the students in a class and left the other half empty-handed. The students with cups were asked to name a selling price, while the others estimated a buying price. The results were striking.

Students with the coffee cups wouldn’t sell for less than $5.25, while those without the cups wouldn’t pay more than $2.25. The difference in perceived value, nearly 50%, highlights the Endowment Effect’s influence.

Your yacht broker or consultant is there to protect your interests, but selling a yacht is challenging. Sellers often want more than the yacht’s worth, while buyers seek a bargain. Your broker’s job is to find a price that attracts buyers while satisfying you, the seller. This negotiation is often the most challenging part of their role.

Understanding the Endowment Effect can help you price your yacht realistically. Overpricing can lead to longer selling times and increased costs for upkeep, depreciation, and market perception.

Several factors can bias your pricing: the time you've owned the yacht, the money and effort you've invested, brand attachment, and the memories associated with it. Be wary of brokers who agree to list your yacht at an inflated price just to secure your business. They may later reduce the price due to lack of interest. Instead, aim to list your yacht at its Fair Market Value for the best results.

How the Sunk Cost Bias Affects You, the Seller

Another psychological bias that could occur during the sale of your yacht is the Sunk Cost Bias. Have you ever held onto an old piece of clothing because it was expensive? Have you ever watched a movie until the end despite the fact that you hated it? Psychologists call this the “Sunk Cost Bias.”

One of the most well-known stories of Sunk Cost Bias is the Supersonic Concorde alliance between the French and British governments. They both poured billions into creating and making that program to run. It was an operational headache, and an absolute financial disaster that cost taxpayers billions! However, they kept the program running until a fatal accident in July 2000 that cost the lives of 109 people. When you’re experiencing the sunk cost bias, you’re not being objective and you may make the wrong decision that could end up costing you a lot of money.

Buyers Won’t Pay More Than Necessary

Adding to the challenge of pricing your yacht is the fact that buyers won’t pay more than necessary. After all, they’ve been watching the market’s inventory closely and they know — very well — what’s available and for how much. So, if your yacht is priced too high, it will probably be overlooked. What’s worse, your higher price may even make your competition look better than you.

Why Your First Offer Is Often Your Best Offer

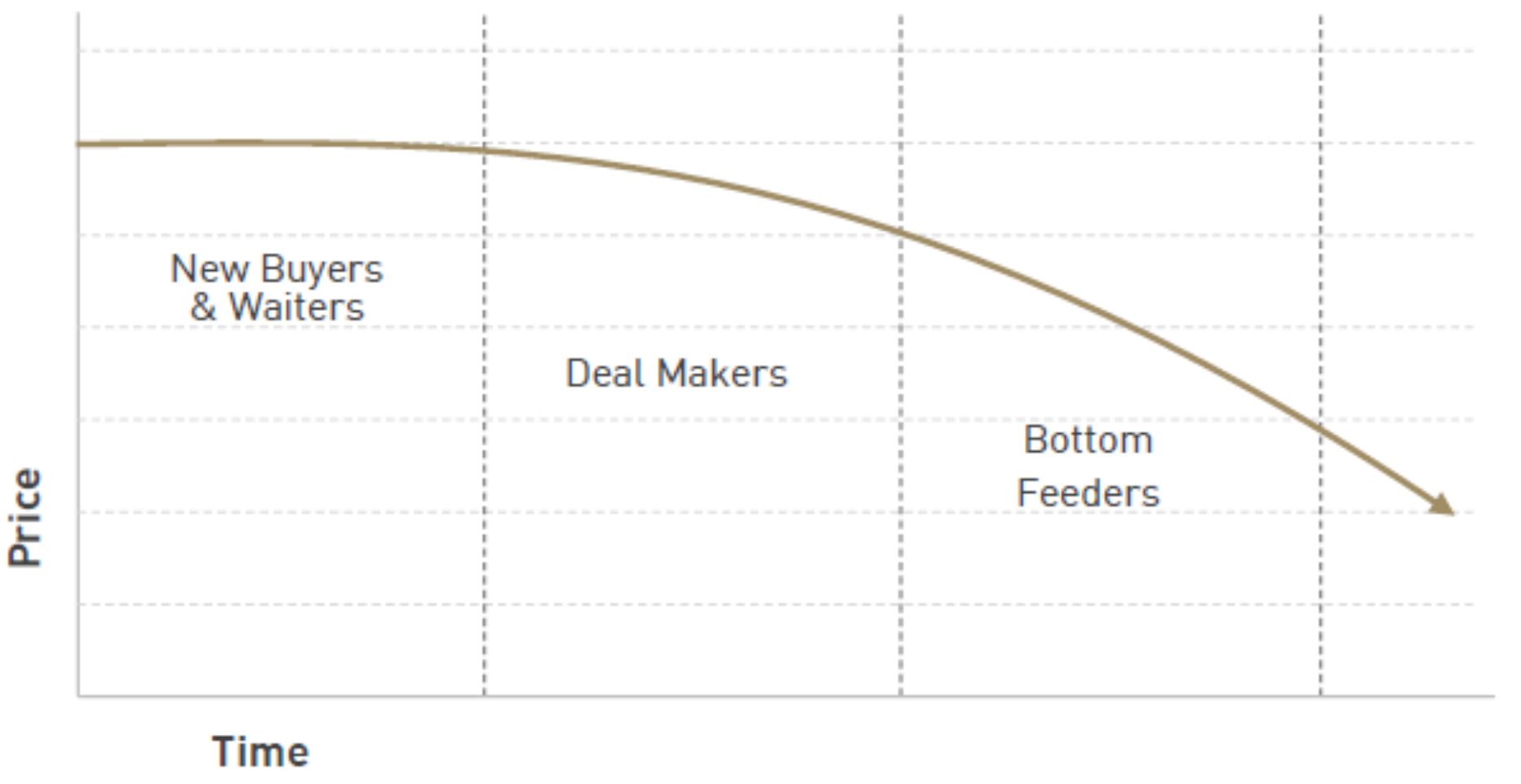

Another common mistake sellers make is to disregard the first offer they receive. Often, if they get an offer quickly, sellers have a tendency to become overly confident and believe they could do better if they wait for another buyer. The truth is, this is rarely the case.

When you first list your yacht for sale, new buyers and buyers who are waiting for the right fit, will inquire or come see your yacht. It is possible, if priced at a Fair Market Value, that you could get a good offer immediately. However, the longer your yacht stays on the market, the more dealmakers it will begin to attract. Then, after more time and price reductions, you will begin to attract the bottom feeders.

Who would you prefer to sell your yacht to?

How to Price Your Yacht to Sell

In order to accurately price your yacht, your broker or yacht consultant should assess it in two ways:

- The current market conditions (these include national and international economic conditions, buyer demand, seasonal demand, the location of the vessel, availability of competing models, and the prices of recently sold yachts of similar models.)

- The specifications of your yacht (the size, design, age, layout, condition, engines, additional options, history, and maintenance.)

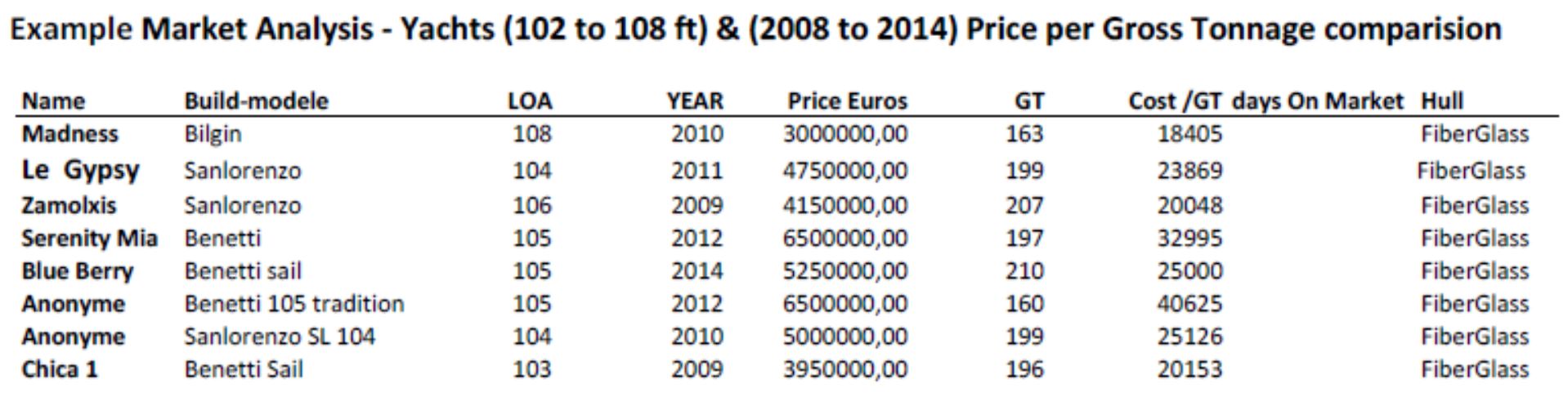

Price Your Yacht Using a Comparative Market Analysis as a Guide

At the end of the day, the price of your yacht is not dictated by you or your broker. The market must be the primary indicator of the price of your yacht. Here is an example of how we conduct a Comparative Market Analysis to determine the Fair Market Value of your yacht.

Specifically, this market evaluation looks at 4 factors which affect the price of your yacht:

- Active Listings: To identify comparable asking prices of similar yachts which are currently competing with yours (Note: remember that these yachts have not yet received an accepted offer.)

- Under Contract Listings: By looking at what other similar yachts have received and accepted to give us an indication of realistic pricing.

- Sold Listings: The prices paid for recently sold yachts provide the best foundation in determining your yacht’s most accurate market value. (Note: adjustments must be made for your yacht’s build year